Initial Public Offerings

Initial Public Offerings (henceforth IPO) in Nepal are announced every now and then. IPOs allow us to invest in a company and purchase its shares for the very first time. It gives us the opportunity to get the shares at the minimum price of Rs. 100 before it is traded publicly.

To invest in an IPO, one must be aware of the announcement. The sale goes usually for 4 working days and it is within those 4 days you must get the forms, fill it up and submit it to a collection center along with an investment amount. Then we have to wait a number of days which is usually around 50 for the allotment to be concluded. Then depending upon the number of shares issued and your amount of investment, you are allotted a particular number of shares. The excess amount is returned back. After a few days, the share certificate can be collected and you will be the proud owner of stocks in the company who’s IPO you just applied for.

Requirements:

- Has to be a citizen of Nepal.

- An attested photocopy of Nepali citizenship (Write सक्कल बमोजिम नक्कल ठिक छ। behind it and sign).

- A recent passport size photograph.

- A bank account for every person that wants to invest.

- A check book or cash for up to Rs. 50,000 in investment.

IPO Application Process

1. Know the IPO Dates

To find out the IPOs that are up-coming, follow the news related to economy and business. For online sources, the IPO News page at Nepalsharemarket.com is a good one. There might be other sources from popular sites like ShareSansar.com. These sources will tell us the number of shares that are being issued to the public, the collection centers and the time period of the application process. There will also be additional information for investors such as the company’s financial statements and even their simple analysis which is done regularly by sites like ShareSansar.

2. Decide on How Much to Invest

Decide on how much you want to invest. In Nepal a unit of share in an IPO is always Rs. 100. The minimum amount of shares you can invest in is 50 shares per person which costs Rs. 5,000. The maximum depends on the size of the company. It can be as low as 1000 units per person; it is commonly 5000 units and the amount can be higher than that as well.

Note that people investing up to 500 units are considered as small investors and small investors are generally allotted more shares than large investors—people investing more than 500 units or Rs. 50,000. So you might not want to apply for shares which are only a bit higher than 500 units or Rs. 50,000. Example: Investing Rs. 51,000 or Rs. 55,000.

People usually apply for IPOs in the name of multiple people, like their family and relatives. Fill up multiple forms and submit multiple applications for this.

3. Get the Application Forms

When the actual IPO starts, know where the forms are being distributed. News sites like ShareSansar and NepalShareMarket.com lists such locations. For example: This newspaper scan by NepalShareMarket.com has all the information including the financial institutions where the forms are being distributed. Be sure to choose a location near your place because you will have to visit the place multiple times to collect the application forms, to submit it, to get the return amount for shares that aren’t allotted and finally, to receive the share certificate.

4. Fill the Application Forms

Fill up the forms accurately. Write names (your, your father’s, grandfather’s and/or spouse’s), contact information, number of units to apply, amount in NPR, and so on in their respective places in the form. Double check everything including the bank account number, name and address. For every form, there should be a unique person and a bank account name that matches the person who is submitting the form.

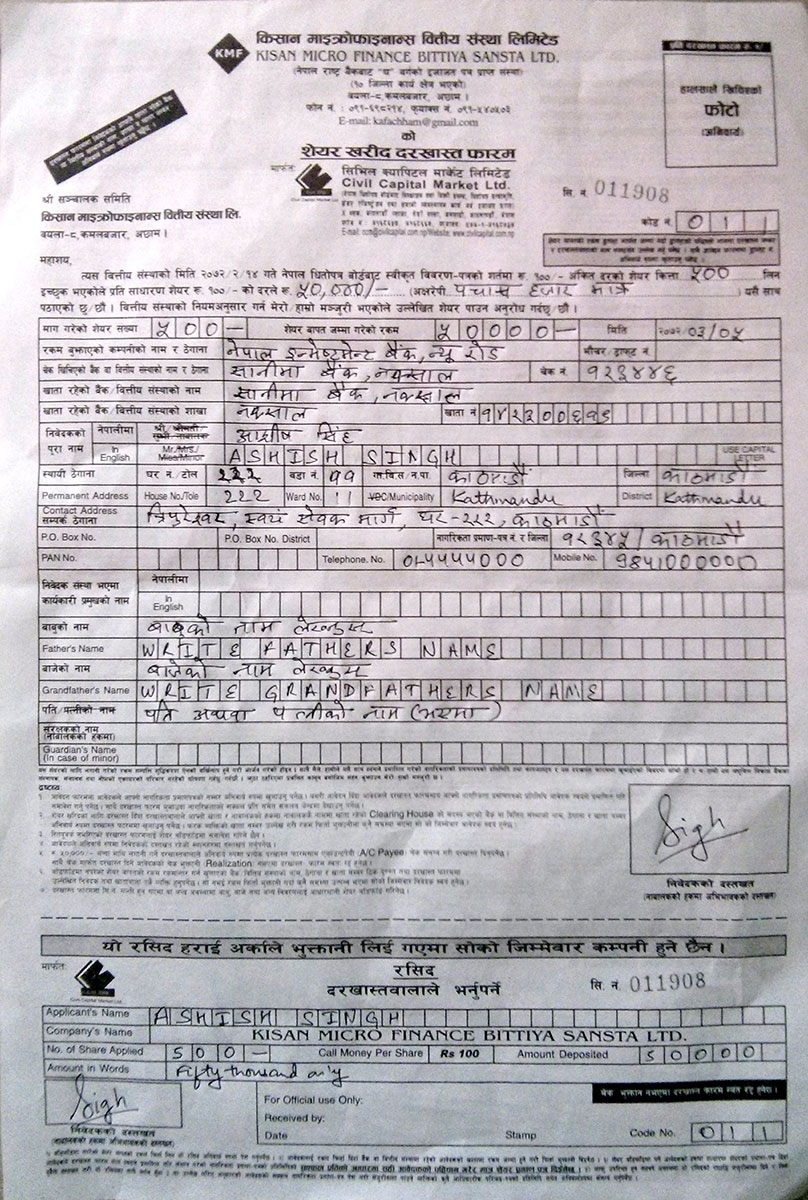

Also, note that the form requires you to write in Nepali in some place and in English in other places. It might be confusing for first timers. So, here is a sample form that has already been filled up:

Do not forget to paste your photo. The details are just as an example. Also, do not get confused and fill up the form with your own details. If you don’t know what to fill in a particular field like “Code No.” then leave it empty and ask a responsible person at the collection center during the time of submission.

5. Get the Amount Ready

Have the amount ready. Every share costs Rs. 100, so do the math. If you want to use a check to submit the amount, make sure your bank account has the appropriate account balance. If you want to submit an amount directly (which is only possible up to Rs. 50,000) then keep the amount at your hand.

For checks make sure it is an account payee check by writing A/C Payee on top of the check. The same check number should be present in the form as well. For the “Pay To” part of the check, ask the collection center about what to write there. It is usually the name of a financial institution where you are submitting the form.

6. Submit the Form

Visit the collection center, submit your form along with the attested copy of citizenship and the check or cash. For multiple forms, you can use a single check. Just write the same check number on all application forms. Behind the check, you will be asked to write the form serial numbers for multiple forms and sign.

Just know that when the un-allotted cash is returned back, it comes in the form of multiple checks issued for each person that has applied. Even though you submitted one check, expect multiple checks back in return. Since those checks will be account payee checks with bank account names and number of all the people who have applied, they should all have their own bank accounts. This bank account detail should also be present in the form.

After everything is thoroughly checked at the collection center, submit the form. You will be provided the bottom piece of the form which is needed later to collect the allotment paper.

7. Allotment

After around 50 days, there will be a public announcement that the shares have been allotted. The total investment amount collected during the application process will always be high than the requested amount. Expect oversubscription. Everyone will not get all the shares that they apply for. The allotment will be done proportionally and on a lottery basis for amounts under a certain threshold.

After you are allotted a certain proportion of your application amount, go back to the financial institution where you submitted the form. Give them the part of the form that you got back. They will give you another paper which includes a check and an allotment paper. Deposit the checks in their regular bank accounts. Use the allotment paper to receive the share certificate on a future date.

thanks for infromation

जवाब देंहटाएं